Difference between investment and savings

When it comes to our finances, there are a lot of important decisions to make. One of the most fundamental choices is whether to save or invest our money.

While the two concepts are related, there are distinct differences between them. In this article, we will explore the difference between investment and savings and help you decide which option is best for you!

How are saving and investing different?

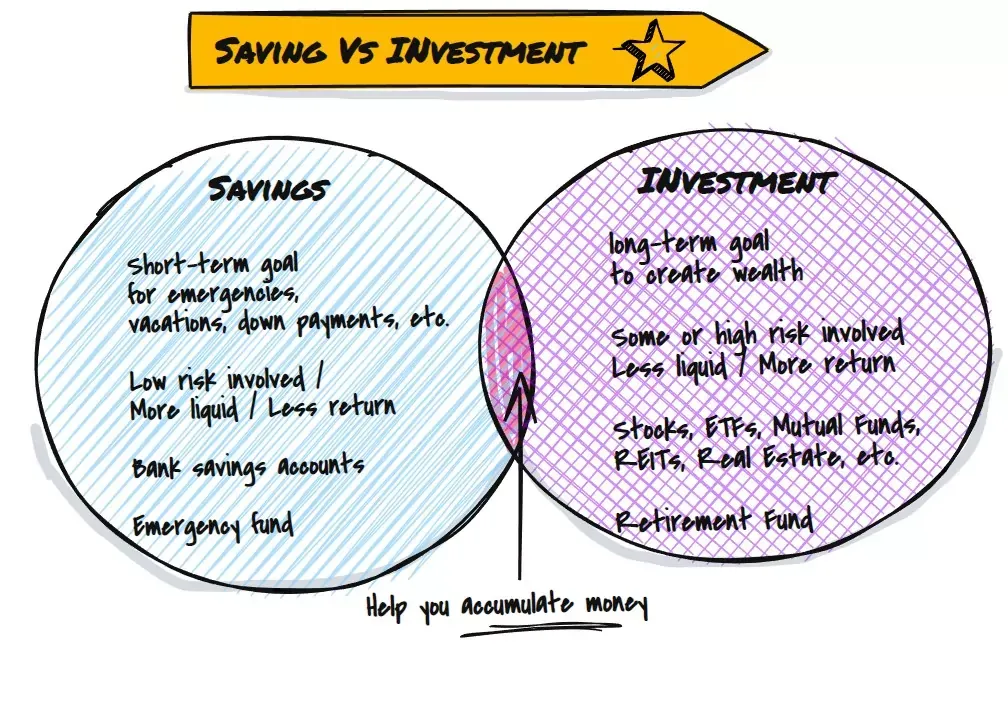

Saving and investing are two important concepts to build a solid foundation. Both will provide better future financial comfort, and help you accumulate money, but consumers should be familiar with the key differences between saving vs. investing.

One of the biggest differences is that when you save, you're typically looking to preserve your money and may lose acquisition power in the process due to inflation.

Inflation is a general increase in prices and a fall in the purchasing value of money. It occurs when the demand for goods and services exceeds the available supply.

The main cause of inflation is an increase in the amount of money in circulation. When more money is chasing the same number of goods, prices go up.

Inflation can be harmful because it reduces people's ability to save and invest. Low inflation levels are generally considered good for the economy, but high levels can be very damaging.

On the other hand, when you invest, you're typically looking for growth in your money and understand that there is risk involved, which may lead to losses in some cases.

Another big difference is how each approach is taxed. Money earned in a savings account or money market account is taxed as ordinary income, while investment gains are typically taxed at a lower rate.

The difference between saving and investing

Saving is typically considered a good way of reaching financial goals in the future, and it should be included in your budget.

A savings account is more liquid than an asset. Investment, however, can help you achieve longer-lasting objectives.

In both investment and saving, patience is the best. The more time invested, the more the opportunity for growth resulting in re-investment of investment earnings for potentially higher returns.

How does investing work?

According to Investopedia, an investment is an asset that you purchase with the expectation that it will generate income and will increase value over time.

When it comes to making sound financial decisions, there's no question that you need to take more risks to earn more wealth. However, with so many different investment products on the market, it can be difficult to determine which ones offer the greatest growth potential.

Before investing your hard-earned money, it's important to do your research and understand the inherent risks associated with each product. Additionally, always consult with a qualified financial advisor to get their expert opinion and ensure that you're making the best possible choices for your individual situation.

That said, here are different investment products that offer the potential for significant returns over time, but each comes with unique risks and rewards, so be sure to weigh all of the pros and cons before deciding which is right for you.

Some types of investments need time to mature, and it can cause costs or penalties for losing money before their term expires.

Other investments are more marketable, and you can't sell during a market downturn. You can invest with your retirement account. your 401k, IRA, etc.

Why Investing is important?

Investment is important because it allows individuals and businesses to allocate their resources in a way that will create the most value for them in the future. By investing in things like stocks, bonds, and real estate, people can hope to create wealth and financial security for themselves and their families. In addition, investment plays a key role in economic growth, as it allows businesses to expand and creates jobs.

How do savings accounts work?

A savings account is a type of account where the holder deposits money for safekeeping. The holder can then withdraw the money as needed.

This type of account is insured by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000 per individual, so the depositor is guaranteed reimbursement for any losses if the bank becomes insolvent.

Savings accounts offer a higher interest rate than checking accounts, and they typically do not have monthly fees. To open a savings account, the applicant must be a resident of the United States and have a Social Security number.

There are several different types of savings accounts, such as the Money Market Accounts (MMA), but most work similarly. In a Money Market account (MMA), the depositor puts money into the account and earns interest on that money. The interest rate may be fixed or variable, depending on the account.

When it comes to saving money, many people think about putting their funds into bank fixed deposits. This type of account is a financial institution product that allows customers to earn interest on deposited cash over a set period of time.

Banks offer different interest rates for fixed deposits, so it's important to shop around and compare rates before opening an account. In addition, you'll want to make sure the bank you choose is Member FDIC, which means that up to $250,000 is federally insured by the FDIC, and you won't lose money in case something happens to the institution.

There are a few other factors to consider when choosing a bank for your fixed deposit account. For example, some banks allow you to withdraw your funds early without penalty, while others may charge a fee if you do so. You'll also want to be sure that the bank has a good reputation and offers customer service if you have any questions or problems with your account.

Why saving is important?

One reason it is important to save money is that it gives people a cushion against unexpected expenses without having to go into debt. Another reason it is important is that it allows people to invest in assets such as stocks or real estate, which can provide them with a stream of income in the future.

How are saving and investing similar?

Saving and investing share the same aim: they are all ways to get you capital. Both involve putting cash away to pay off for another purpose. Both have special bank accounts in which they can collect cash. Savings can also be opened through the bank or credit union.

Savings are used to build up your financial assets. The point of saving is to build up a pool of capital that you can use later in life.

This requires opening an account with an independent broker, although some of these banks now have brokerages as well. Several prominent online brokers are Charles Schwab Fidelity and TD AMERICOM.

Why is it important to understand the difference between investment and savings?

When it comes to your financial future, it’s important to understand the difference between investment and savings because they serve different purposes, such as having an emergency fund or retirement account. Understanding the difference can help you make better decisions for your capital.

- Savings money is usually putting cash into a bank account where you can earn interest on your deposited funds. Usually, for emergencies, down payments, Christmas gifts, vacations, etc.

When it comes to saving cash, many people think about putting their funds into bank fixed deposits. This type of account is a financial institution product that allows customers to earn interest on deposited funds over a set period of time. Banks offer different interest rates for fixed deposits, so it's important to compare rates before opening an account. Additionally, you'll want to make sure the bank is Member FDIC insured in case something happens to the institution.

For example, having an emergency fund is essential for short-term emergencies. Setting up an emergency savings fund should be a priority before you start investing in other products such as stocks or mutual funds.

If you don’t have enough cash saved up to cover unexpected living expenses - like a car repair or medical bill - you could be in big trouble. The goal is to have enough money in your emergency savings so that you can cover at least three to six months' worth of living expenses in case of an emergency.

- Investing money, on the other hand, is usually putting funds into things that may have potential future rewards, such as stocks, real estate, or businesses.

When it comes to our current financial position, each of us has a different comfort level when it comes to risk. For some, more risk means the opportunity for greater rewards; while others would rather play it safe with a more conservative investment approach. No matter where you fall on the risk spectrum, there are a variety of investment vehicles to fit your needs.

Wealth Management is one option that can provide you with professional advice and guidance when making investment decisions. This service can help you navigate through the many different types of investments available, as well as assess your overall risk tolerance.

In a world where the stock market is constantly changing and future events are impossible to predict, some people may be hesitant to invest their money saved. However, if you're looking for a way to secure your financial future, long-term investments are the way to go.

By buying assets such as stocks or real estate, you can ensure that your capital will grow over time, regardless of what the economy is doing. And while there is always some risk involved in investing, historical data shows that long-term investments tend to perform better than those made in the short term.

If you're not sure where to start, it's best to get some investment advice from a professional. A good financial advisor can help you choose the right assets for your portfolio and give you tips on how to manage your portfolio over the long term.

The federal deposit insurance corporation

The Federal Deposit Insurance Corporation (FDIC) is a federal government agency that was created in 1933 to ensure banks and protect depositors.

If you read that a financial institution is a "Member FDIC", it means that the FDIC insures deposits up to $250,000 per account on that institution, so if a bank fails, the depositors are not at risk of losing their savings. The FDIC also regulates banks and works to ensure that they are safe and sound.

How to pick a good savings account?

When it comes to finding the best savings account, you want to find one that offers good interest rates and it is a Member FDIC (insured bank). The FDIC is a government agency that insures deposits in member banks up to $250,000 per depositor per bank. This means that if the bank fails, your money is still safe. You can check the FDIC website to see which banks are members.

You also want to find a savings account that has a low minimum balance and no monthly fees. Some banks offer high-interest rates but require a high minimum balance or have monthly fees. So, be sure to read the fine print before opening an account.

Finally, be sure to compare interest rates among different banks before you decide on a savings account.

Tell me the meaning of investing?

Investing involves investing your capital into investments that provide potential income or help create wealth in a certain area. Most popular investments in India include stocks and bonds, exchange trading funds & revolving shares. The importance is to keep an eye on the risks of investing.

Tell me the meaning of saving?

Saving is an act of saving money to cover unforeseen situations and expenses. The banks also have several savings choices such as a bank account or deposit bank account, etc.

Mutual funds

There are a variety of different types of investment vehicles, each with its own set of benefits and drawbacks. One such investment vehicle is the mutual fund. Mutual funds offer investors a number of benefits, including convenience, affordability, and diversification. However, they also come with some risks, such as annual fees and the potential for loss. When making the decision to invest in a mutual fund, it is important to consider your financial goals and risk tolerance.

Button Line

It's important to understand the difference between investment and savings. So, what’s the difference between investment and savings accounts? In a nutshell, investments are riskier but provide the opportunity to grow your money, while savings are what help you protect your money and provide a cushion against unexpected expenses or emergencies.

Depending on your goals and the level of risk you are willing to assume, one option may be better for you than the other. It's essential to have a mix of both in order to achieve your financial goals. You should make sure to invest in order to reach your long-term financial goals, and make sure you have enough savings to cover unexpected expenses.

If you want to save for a specific goal in the future (like a down payment on a house), then a savings account may be right for you.

But if you’re looking to grow your funds over time so that you can eventually retire comfortably, then an investment account is probably the way to go.

Let me know in the comments below if you have any questions about which option is best for you!