How Much Should You Save for Retirement?

How much should I save for retirement? That is a question that many people are asking themselves these days. And your financial decisions can vary depending on your present financial situation, your age, income, and other factors.

According to the National Retirement-Risk Index (NRRI) prepared by Boston College's Center for Retirement Research, "about half of the households are “at-risk” of not having enough retirement funds to maintain their living standards in retirement."

However, there are some general tips that everyone can follow in order to make sure they have enough money saved up for retirement. In this article, we will discuss some of those tips, including some specific tax benefits, and provide guidance on how much money you should aim to save each year.

How much money will you need to retire?

This is a difficult question to answer because it depends on several factors, including your retirement age, how long you'll live, and what kind of lifestyle you want in retirement. However, there are some general guidelines you can follow to help you figure out how much money you'll need to save.

First, think about how long you expect to live in retirement. The average life expectancy in the United States is about 79 years, but this number is rising as medical advances allow people to live longer. If you think you'll need retirement income for 20 or 30 years, you'll need to save accordingly.

Next, consider what kind of lifestyle you want in retirement. Do you want to travel? Pursue a hobby? Downsize your home? Your retirement lifestyle will affect how much money you'll need to have saved.

Finally, take into account any other sources of income you'll have in retirements, such as Social Security or a pension. If you have other sources of income, you may not need to save as much money on your own.

Use these general guidelines to help you figure out how much money you need to save for retirement. Keep in mind that your individual situation may require you to save more or less than the average person. The important thing is to start saving early so that you can enjoy a comfortable retirement later.

How to Win at Retirement Savings?

The 401(K) or the Individual Refund Account are currently not required courses in schools. Colleges generally don't teach anything about Roths or 403bs. Then, we wonder why so many people fail to save for their retirement. The problem is, most people have no idea how to go about saving for retirement. Here are a few tips:

Start early

If you want to save now, you should do it now. What are some good savings ideas? - Start right here! What are your reasons for it? For the following reason: A magic of compound interest. You have probably heard about this before. That’s right. If you invest the same amount every year ($5000), earn the same return on your investment every 6-year year, and don't invest when you retire (67), compared to 22 people who start saving at 66, you get almost twice that amount compared to 32.

- The first step is to start saving. It may seem like a difficult task, but it's not impossible. Begin by setting aside a fixed amount of money each month. $50 a month may not seem like much, but it can add up over time. If you're able to save more, great! But don't feel like you have to break the bank in order to start saving.

- The second step is to invest your money wisely. This doesn't mean that you have to become a financial expert, but it does mean doing some research and learning about different investment options. Talk to a financial advisor if you're not sure where to start.

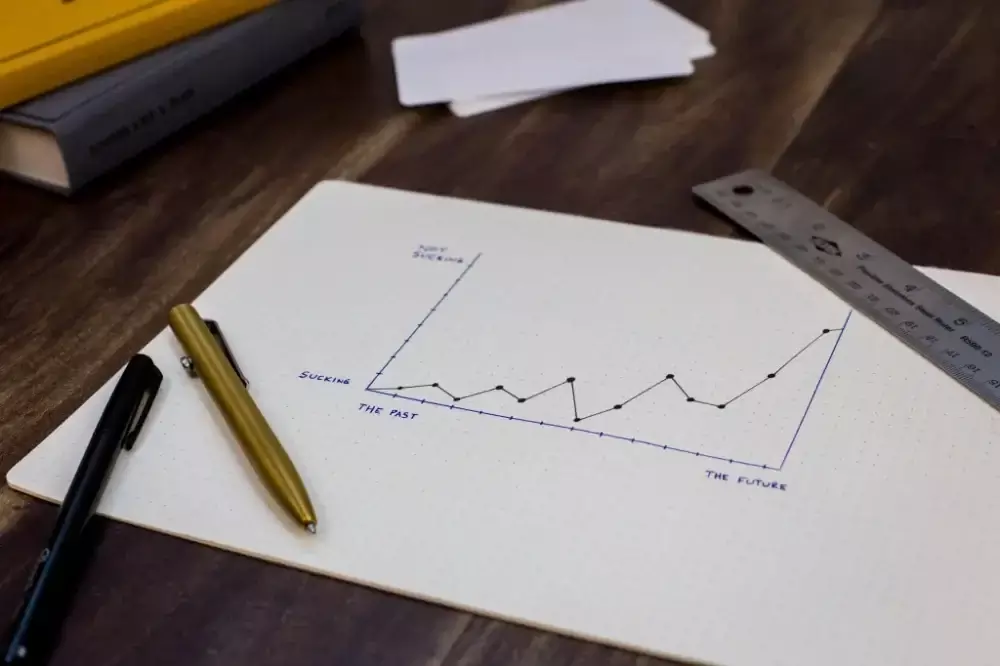

- The third step is to stay disciplined. Retirement planning is a long-term game, so it's important to stick with your savings plan even when there are setbacks. market crashes, job loss, and other financial challenges will happen at some point. But if you remain disciplined, you'll be in a much better position to weather these storms.

How to maximize retirement savings on a budget?

Even if you don't have much money you could save a lot to avoid getting underwater again. How can you incorporate retirement savings into your budget today? The biggest financial regret of American citizens has not been saved before retiring. You want the most money you have available to you, a fast way to compound your profits.

Retirement Saving on a Budget

How big your retirement fund should be is a difficult question. The answer depends on many factors, but if you break it down, the steps become clear. Begin with your current age and calculate how many years until you plan to retire. If you are 50 years old and plan to retire at 67, you have 17 years to save. Then, you need to calculate how much money you will need to have saved.

A good rule of thumb is to have enough saved to replace 70-80% of your current income. Therefore, if you make $50,000 per year, you would need $35,000-$40,000 per year in retirement.

To come up with this number, think about what your retirement lifestyle will look like. Will you travel? Do you plan to downsize your home? What other hobbies or activities do you want to pursue? All of these factors will play into how much money you will need to have saved.

Once you have estimated your retirement goals, you can begin saving.

Do you want to save for early retirement?

Short answer, yes! This question has the same answer as "when is the best time to plant a tree? or when is the best time to dig a well?" The best answer, a long time ago, the best second answer, if you haven't done it yet, it's right now!

How much should I start saving when my retirement years are over? Normally the figure is too high or early to be accurate. Starting late means saving a bigger part of your budget in a retirement account versus wasting more of it. Someone starting a savings plan at age 35 might hypothetically afford their retirement with 24% or 15% of their monthly income until age 62.

Understanding your retirement account options

If you are considering retiring, make sure you invest it carefully. The retirement accounts are a gigantic bowl of alphabet soup: 420 (c), 457 (b), 401(k). Over the years, these retirement accounts were created with specific purposes to help individuals who could not get everything they had. Its effect is that many are left confused. You must first understand what account options you have which will depend greatly on where you work.

Health savings account (HSA)

One of the best ways to save for retirement is to invest in a health savings account, or HSA. An HSA is a tax-advantaged account that can be used to pay for qualified medical expenses.

Contributions to an HSA are made with pre-tax dollars, which means they lower your taxable income. And, if you use the money in your HSA to pay for qualified medical expenses like healthcare costs and medical costs in general, the withdrawals are tax-free.

HSAs are an excellent way to save for retirement because they offer a triple tax advantage:

- Contributions lower your taxable income.

- The money grows tax-deferred.

- Withdrawals are tax-free if used to pay for qualified medical expenses.

With health care costs rising, an HSA can be a valuable tool to help you pay for medical expenses in retirement.

If you're eligible to contribute to an HSA, it's worth considering as part of your retirement savings strategy.

Get Free Money!

If your company offers employers an employer-sponsored retirement plan, like a 401(k), and matches your portion of your employee contributions you may place your money into that account at least until you're paid.

Look at 401(k)s as free money you don't want to leave on the table. Having more money available for your annual spending once you have retired is always a good idea!

If a plan is not providing matching employer contributions or you are not using an employer retirement plan, then you need to go ahead to a financial institution and do it right now!

Retirement accounts:

If you're ready to retire you will have to make your own choices about what and when to save. And, with so many retirement account options available, it can be hard to know which is right for you.

A tax-advantaged account offers special benefits but these come at a cost - they will limit your freedom and make taxes more complicated than if you had invested in an unrestricted way! In this section, we take a look at the two main types of individual retirement accounts (IRAs).

IRAs are great if they provide you with a tax exemption when you save and the resulting IRAs also provide you with many benefits. Different types of benefits depend on the types of IRAs. What are the different types of IRAs?

Roth IRA

If you're in your 20s or 30s, you may not be thinking about retirement just yet. But it's never too early to start saving! One of the best ways to save for retirement is with a Roth IRA.

Named after former Senator William Roth, a Roth IRA is an individual retirement account that offers tax-free growth and tax-free withdrawals in retirement.

Here's how it works: you contribute money to your Roth IRA, and that money grows tax-free. When you retire and start taking withdrawals, those withdrawals are also tax-free.

There are a few things to keep in mind with a Roth IRA.

- First, there are contribution limits: in 2020, you can contribute up to $6000 if you're under age 50, or $ 7000 if you're over age 50.

- Second, there are income limits: if your modified adjusted gross income is over a certain amount, you may not be able to contribute to a Roth IRA at all.

- Third, you don't get a tax break on the money you contribute to a Roth IRA, but your withdrawals in retirement are tax-free. That's because, with a Roth, you fund your account with after-tax dollars. The money you contribute has already been taxed, so you don't have to pay taxes again when you take it out in retirement.

Traditional IRA

A traditional IRA gives you tax advantages on the contributions you make. The IRS clarifies that the contributions you make to a traditional IRA may be fully or partially deductible, depending on your filing status and income. If you're covered by a workplace retirement plan, your deduction may be reduced or eliminated.

Differences Between Roth IRA & Traditional IRA

Roth IRAs are different from Traditional IRAs in a few key ways.

First, with a Roth IRA, also called a "tax-advantaged retirement account", you contribute money that you’ve already paid income taxes on. This means that when you retire and start taking withdrawals from your account, you'll have the tax benefit of not having to pay any taxes on the money you take out. On the other hand, in a traditional IRA, the contributions may be fully or partially deductible.

The second way Roth IRAs differ from Traditional IRAs is in the way they’re taxed. With a Traditional IRA, you get a tax break upfront on the money you contribute. This means that when you retire and start taking withdrawals, you’ll have to pay taxes on the money you take out. With a Roth IRA, you don’t get a tax break upfront. This means that when you retire and start taking withdrawals, you won’t have to pay any taxes on the money you take out.

The third way both IRAs differ from each other is in the amount you can contribute. With a Traditional IRA, you can contribute up to $5000 per year. With a Roth IRA, you can contribute up to $6000 per year.

401(k)

A 401(k) is a retirement savings plan sponsored by an employer. It lets you set aside money from your paycheck before taxes are taken out. Taxes on the money in a 401(k) are deferred until withdrawal, which usually occurs during retirement.

401(k)s are a great way to save for retirement because the money you contribute reduces your income to be taxed for the year. This can lead to a lower tax bill now and deferred taxes on the earnings in your account until you withdraw money in retirement.

Many financial advisors will tell you that you can claim Tax Breaks by delaying paying income tax using traditional 401(k)s or IRAs and even prepay it by saving in Roth accounts.

There are some things to keep in mind with 401(k)s, though. Many 401(k) plans have fees associated with them, and the investment options in a 401(k) may be limited. It's important to consider these factors when deciding how much to contribute to a 401(k).

401(k) plans have three types of fees: investment, administrative and fiduciary. The first two can be broken down into various subcategories but the last one is an umbrella term that covers all these costs in more detail so it's easiest to just refer back here for clarification if the need arises!

Take into consideration that, while a 401(k) is subject to early withdrawal rules, Roth IRA's are not. This means that you can take money out of your account without paying taxes or penalties--just remember if the withdrawer has been under 70 when you initiated your retirement savings plan, then there will be additional requirements based on how long ago you started contributing to this type of retirement accounts.

Self-employed retirement savings

Self-employment earnings can help you save in your Solo 401(ks), as well as in your Simplified Employee Pension plan (SEP). You can contribute 5% to your total net income through a SEP.

The IRS tells us that your total annual employee contributions to all the plans can't exceed your personal limit of $20,500 in 2022 ($19,500 in 2020-2021; $19,000 in 2019), plus an additional $6,500 in 2020-2022 ($6,000 in 2015 - 2019) if you're age 50 or older.

Grab the 401(k) or 403(b) Company Match

You can contribute as long as the company provides an investment plan. To maximize your retirement benefits, make a maximum contribution from your retirement savings plan. Take action to maximize your financial gains. Here are examples of their methods.

Let José earn $50,000 each year. In fact, the employer pays up to 55% of his salary and he matches all of the cash in his work-related retirement accounts. In his 401k he will receive an automatic $2,500 bonus and significant taxes.

Benefits of getting older

If you are under 50 you can rely on taxation. Pension plan contributions have been increased, thereby allowing for faster retirement savings. In 2021, the maximum employee contribution is $19,500. The employer can contribute an additional $6000 in catch-up contributions for a total of $25,500.

For those aged 50 and over, you are eligible to make "catch-up" contributions. These are additional funds that you can contribute to your retirement savings plan above the standard contribution limits. The catch-up contribution limit for 401(k)s is $6000 in 2021. This can be a great way to boost your retirement savings if you're behind on your retirement savings goals.

Claim Double Retirement Plan Contributions

A little-known retirement saving opportunity offers teachers a double-payoff option for their retirement plan due to catch-all provisions in the law. It is applicable to certain participants in 457(b) and 403(b) of an insurance plan. Details can be found on both sites of the federal government, the IRS site, and also on the U.S. Securities and Exchange Commission (SEC) Site, where you can find a whole Guide for Teachers on how to save and invest. This worker may apply for 403(b) or 457(b) retirement savings accounts for up to 19,500 in 2019 and for 2025 up to 20,500.

The Stock Market and Index Funds

The stock market is a great way to invest for retirement. You can start investing with as little as $100 and there are many ways to invest in the stock market. One way to invest in the stock market is through index funds. Index funds are a type of mutual fund that tracks a specific index, such as the S&P 500. Index funds are a great way to invest because they offer diversification and are low-cost.

Another way to invest in the stock market is through particular stocks. When you buy an individual stock, you are buying a share of a company. Individual stocks have the potential to provide higher returns but can be more volatile than index funds. That is why it's so important to have a clear understanding of how you are going to establish your asset allocation so that you don't put at risk your retirement nest egg.

You can either use the services of a certified financial planner or set up the services of a Robo-Advisor. We advise against the hire of brokerage services. To find out why, we suggest you read our articles about how to invest money, even if you don't know how to do it, and also our article about Robo-Advisors to balance your investment portfolio.

Social Security (S.S.)

The Social Security Administration states on its website that it "is part of the retirement plan for almost every American worker. It provides replacement income for qualified retirees and their families."

The website goes on to say that "In order to qualify for Social Security benefits, a person must have worked and paid (SS) taxes for a certain number of years. The number of years required depends on the person's date of birth."

For example, if you were born between 1943 and 1954, you need to have worked and paid taxes for at least ten years. If you were born after 1960, you need to have worked and paid taxes for at least 40 quarters, or ten years.

You can start receiving benefits as early as age 62, but if you wait until your full retirement age, which is between 66 and 67 depending on your year of birth, you will receive a higher benefit.

If you decide to retire before you reach full retirement age, your benefits will be reduced by five-nine percent per year, depending on how early you start receiving them.

On the other hand, if you wait to claim benefits until after your full retirement age, your benefits will increase by eight percent per year.

The Social Security Administration website has a Retirement Estimator that can give you an idea of how much you can expect to receive in benefits if you retire at different ages.

It is important to remember that (SS) was never meant to be the only source of income for retirees. It is meant to supplement other sources of income, such as pensions and savings.

Pensions

Some people are lucky enough to have a pension plan through their employer. If you have a pension, you may not need to save as much for retirement because you will have a guaranteed income stream coming in. However, pensions are becoming less and less common, so don’t count on having one.

Retirement planning

When it comes to retirement planning, the great majority of financial advisors recommend setting up an emergency fund as a first step toward your retirement readiness.

An emergency fund is defined as three to six months' worth of living expenses, kept in a savings account or other safe place, that can be used for unanticipated costs like a job loss, medical emergency, or home repairs.

While an emergency fund is important, it's only one piece of the retirement puzzle.

For most people, saving for retirement will require a more comprehensive approach. For example, since you pay income taxes, use your tax refund to boost your saving for retirement.

The bottom line

In conclusion, there is no one definitive answer to the question of how much to save for retirement. However, by taking into account your age, income, and other factors, you can make better financial decisions of how much you need to save in order to have a comfortable retirement. So start saving today and you will be on your way to worry-free retirement!

Let me know in the comment below if you have any questions about saving for retirement!