Why is it Important to Save and Invest for Retirement

Saving and investing for retirement is one of the most important things you can do for yourself and your future.

In this article, we'll learn about the importance of saving and investing for when you reach retirement age; the benefits of starting early.

As well as the importance of consulting a financial professional early in the process to understand our different options for saving for retirement, while we take advantage of any tax deduction we might qualify for. This financial professional can helps us to set up our assets allocation, depending on how much risk we are willing to take.

Reasons to save for retirement:

Retirement is a time when many people plan to stop working and enjoy their lives. Unfortunately, retirement doesn't always turn out that way. Some people end up having to work longer than they expected, others don't have enough money saved up, and still, others can't afford to retire when they want to.

It's important to plan for retirement and save as much money as possible so you can live comfortably in your old age. There are a lot of ways to do this, but one of the best ways is to invest your money.

The average American spends less than half of their income on retirement, leaving a shortfall of more than $1 trillion. Yet many people don't even begin saving for retirement until they're in their 50s or 60s.

If you're not yet retired, you need to start saving for retirement even earlier, because the longer you wait, the higher your taxes will be and the smaller your nest egg will be. Here are six reasons why it's important to save and invest for retirement:

- You'll have a cushion for emergencies.

- You can stop worrying about money in retirement.

- You can travel and enjoy life more.

- You won't have to rely on family or friends for support.

- Your savings will last longer if you invest them wisely.

- You'll have peace of mind in retirement knowing you're taken care of financially.

How to save for retirement:

Retirement is something that many people think about, but few people actually plan for it. To have a secure retirement, you need to save money and invest it wisely. Here are some reasons why it's important to do both:

- A secure retirement is one of the biggest things you can give yourself in life.

- Investing your money allows you to grow your money over time, which will help increase its value.

- Saving your money also allows you to live comfortably in retirement without having to rely on Social Security or other government benefits.

Types of retirement savings accounts

There are many different types of retirement savings accounts. The most common are 401ks, which are offered by most financial institutions. There are also other products such as insurance products that can be used for retirement savings.

It is important to understand the different types of retirement accounts available and how they work so you can choose the best one for you.

One type of employer-sponsored retirement account is a 401k. This account allows you to save money on a pre-tax basis, which reduces your taxable income.

The money in the account grows tax-deferred, meaning you don't have to pay taxes on the gains until you withdraw the funds.

401(k) Retirement plan

A 401(k) employer-sponsored retirement plan is a savings plan that allows employees to save for retirement. The plan is named after the section of the Internal Revenue Code that created it.

As we mentioned before, employees may contribute a portion of their pre-tax income to the account, allowing their contributions and any earnings on those contributions to grow tax-free. Employers often match employee contributions, making the plan even more beneficial.

Ensure that a 401(k)s retirement plan is available for you before you set up any IRA, particularly in cases where the employer is matching your contributions. Companies typically match an amount from the salary like three percent, for those who contribute also to the retirement plan.

What happens if you change jobs?

You have the ability to combine the savings with another retirement plan when you quit your job.

Usually, you will put your funds in a brokerage, but many employers may try to convince you to leave your previous account under their own management.

IF YOUR EMPLOYER OFFERS NO PLAN OR YOU'RE SELF-EMPLOYED

When establishing a personal retirement account, people typically work with financial-services companies like large financial institutions or brokerage firms for advice.

Get the most accurate IRAs. Ask your bank for a comprehensive list of charges for comparison of the charges and the rates.

What's the fee for selling an investment? Do account managers pay maintenance fees when they don't have sufficient funds?

IF YOU WORK AT A NONPROFIT EMPLOYER

There are a variety of retirement plans available to employees of nonprofit organizations. The most common plan is the 401k, in which employees contribute a portion of their salary to the plan and the organization matches that contribution.

The most common type is a 403(b) plan, (which is similar to 401ks but is for employees of educational institutions and other tax-exempt organizations). They are tax-deferred retirement savings plans. Employees contribute pre-tax dollars to the plan, and the money grows tax-free until it is withdrawn in retirement.

Other options include 403b, 401(a), and 457 plans (which are available to state and local government employees as well as nonprofit workers).

Best retirement account

There is no one "best" retirement account, as the best option for you will depend on your individual circumstances. Some factors to consider include how much money you have to contribute, whether you want to contribute pre-tax or post-tax dollars, and when you want access to your funds. Some common retirement account options include 401(k) plans, Roth IRAs, and traditional IRAs.

Types of IRA Accounts

There are a few different types of IRA retirement accounts: traditional, Roth, SEP, and SIMPLE.

A TRADITIONAL IRA is a tax-deferred account, meaning that you don't have to pay taxes on the funds you contribute until you withdraw them.

A SEP is a Simplified Employee Pension plan, which is a type of retirement savings account that allows employees to contribute pre-tax income to a retirement fund. Employers can also contribute to SEP accounts on behalf of their employees.

SIMPLE IRA plans are similar to SEP accounts, except that employers are required to match employee contributions up to a certain limit.

With a Roth IRA, you contribute after-tax dollars, but the funds grow tax-free and you can withdraw it without penalty in retirement.

Roth IRA

While there are no current-year tax benefits with a Roth-IRA, your contributions and earnings can grow tax-free, and you can withdraw them tax and penalty-free after age 59.5 and once the account has been open for at least five years.

Understanding your investment account options

It is important to understand the different account options that are available to you to make the most informed decision about how to allocate one's assets.

Asset allocation is the strategic distribution of investments among different asset categories in order to achieve the desired risk and return level.

A variety of factors should be considered when determining an asset allocation, including an individual's investment goals, time horizon, and risk tolerance.

The most common account options are taxable accounts and tax-deferred accounts.

- A taxable account is one in which any profits you make on your investments are taxed as regular income.

- A tax-deferred account, on the other hand, allows you to postpone paying taxes on your investment profits until you withdraw the funds from the account.

Benefits of saving for retirement early

If you can save a little, today will be your ideal day. Tell me about the easiest way to save before retiring: Start today. Tell me the reason? Two things: Magical compounding. You're probably already familiar with this but you can easily understand it if you just look at it.

How much should I save?

The answer will vary depending on:

- At what age do you want to retire.

- How many more years do you expect to live after you retire.

- If you still have debts, how much are your monthly obligations?

- How much are your total monthly expenses?

- The total amount of income that you will receive if any after you stop working. That includes pension, interests, government benefits, etc.

if your obligations are more than your total income during your retired years, you are in trouble!

Make retirement your first priority, especially early on

When it comes to planning for your life after you stop working, the sooner you start saving, the better. That's because your savings will have more time to get compounded monthly, which means that your savings will grow exponentially!

Even if you can't afford to save a lot initially, anything you can contribute, when you start saving early, will help you build a comfortable retirement fund.

One way to reach your investment objectives easier is to automate your contributions. Have a set amount automatically transferred from your checking account to the financial institution you held your retirement account every month. This way, you won't even miss the money, and you'll be on your way to a secure retirement.

The amazing power of starting early

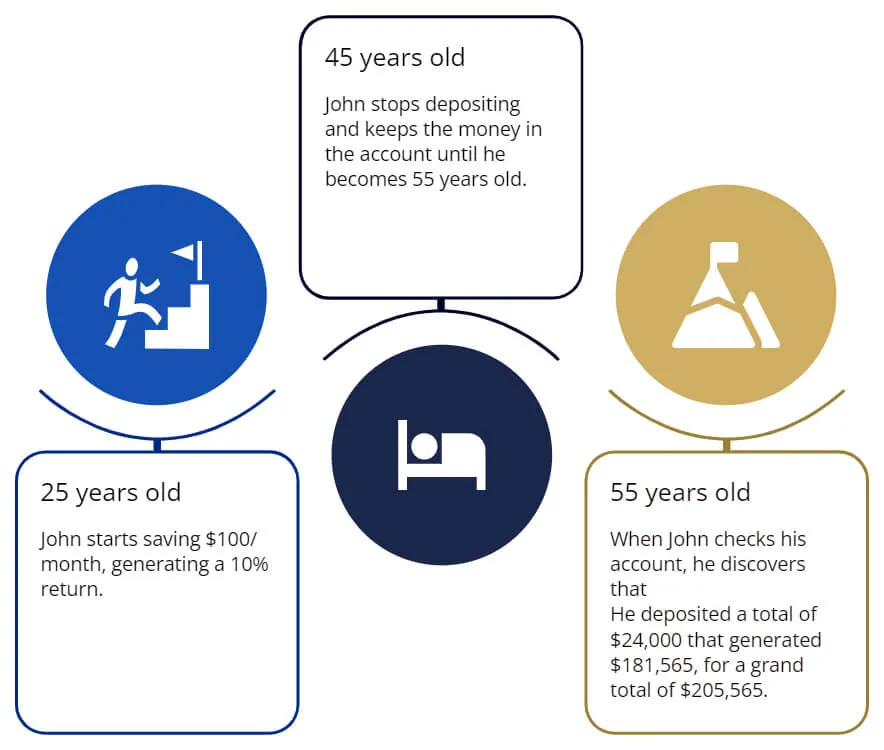

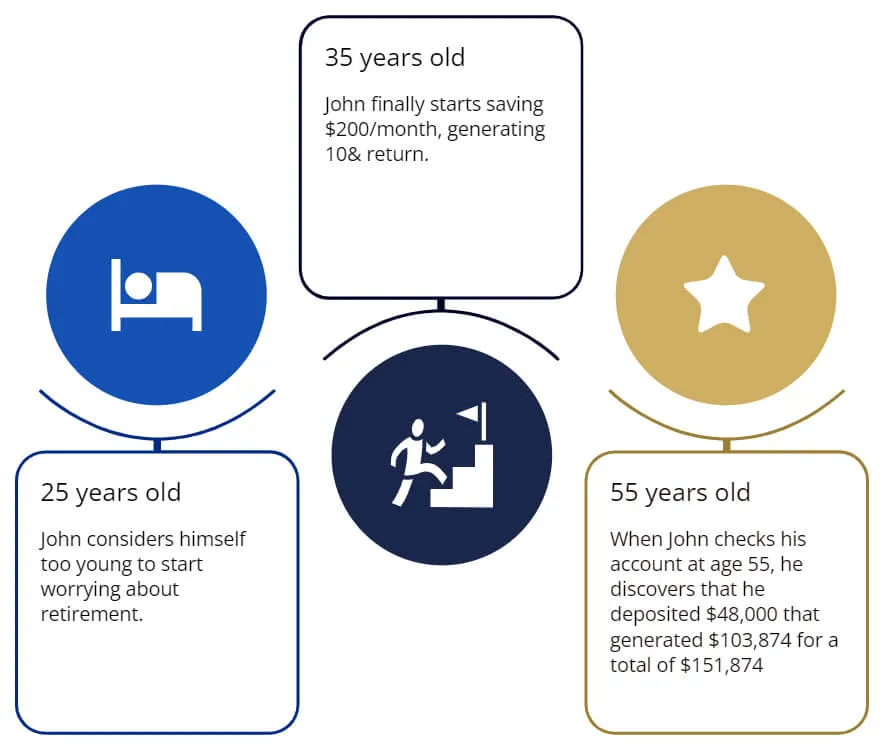

Let's take a look at these two scenarios, assuming a return of 10% a year, compounded monthly for both cases:

You start saving $100 per month at age 25, and you do it for 20 years (from ages 25 to 45). And you stop making deposits after that. For a total contribution of $24,000. Then, you decide to keep the funds in your account for another 10 years. When you are 55 years old, you will have $205,565 in your account.

Now, in this second scenario, you decide to start saving at age 35. and you deposit $200 per month trying to close the gap created for starting 10 years later. And you keep doing it until you reach the age of 55 years old. You would have made a total contribution of $48,000, but you would only have in your account $151,874. You would have put twice as much, but you would be $53,691 short in comparison to the first scenario.

Compound Interest Is Your Friends

Compound interest is a financial term that describes the interest earned on an investment that is compounded periodically.

This means that the interest that has accrued over time is added to the principal amount, and then the new total is used to calculate the following period's interest.

This process can be repeated over and over, which can lead to sizable returns over time. In the end, what we have is an exponential function that calculates the value of a financial asset over time.

Structure your retirement planning as early as possible

When you’re young and just starting out in your career, it can be tough to think about the future and have a retirement plan in place. But if you want to enjoy a comfortable life after you stop working, it’s essential to start saving for your post-work years as early as possible.

When it comes to financial planning, retirement is one of the biggest goals people have. But the truth is, there is no one-size-fits-all answer when it comes to retirement planning. Financial goals vary from person to person, and what might be the right strategy for one person might not work for someone else.

That's where financial professionals can help. A certified financial planner can help you create a personalized plan that takes into account your unique circumstances and goals. A financial advisor can help you figure out how much money you'll need to live comfortably after you stop working and how best to save for that goal.

Pay Income taxes

When a person retires, they often have to start withdrawing money from their account. This money is taxed as income, which can result in a higher tax bill. However, there are some ways to minimize the amount of taxes you have to pay on your retirement income. One option is to delay taking Social Security benefits until you reach 70 years old, which will allow you to keep more of your retirement money tax-free.

When a person contributes to an account, like a 401k, the money is typically taken out of their paycheck before taxes are deducted. This reduces the amount of taxable income for that year. When it comes time to withdraw money from the account in post-work years, the funds are taxed as regular income. This can result in a smaller nest egg than if the contributions were made after taxes were paid.

Teacher’s Retirement

According to research made by the National Association of State Retirement Administrators (NASRA), about 40% of teachers do not pay into the Social Security system, making them ineligible to claim benefits once they retire.

Teachers often have a lot of questions about what the best investment options are for them. Many teachers do not realize that they can contribute to a 403(b) plan and receive matching funds from their employer.

A 403(b) is a retirement savings plan that is specifically designed for employees of educational institutions and nonprofit organizations.

The money contributed to a 403(b) grows tax-deferred, which means that you do not have to pay taxes on the earnings until you withdraw them. This can be a great option for teachers who want to save for retirement but do not want to pay taxes on their contributions.

Conclusion

There are many reasons why it’s important to save and invest for retirement. One of the most important is that it can help you maintain your lifestyle in your post-work years.

Saving and investing for when you retire may seem like daunting tasks, but it is important to start as early as possible. The earlier you start saving and investing, the more time your money has to grow. And if you are able to invest your savings, you could potentially end up with a much larger nest egg than if you had just kept your money in a savings account.

Saving and investing for your post-work years can also help you protect your assets and keep them from being depleted too quickly.

If you don’t have enough saved, you may have to make some tough choices about how you spend your money. You may have to downsize your home, forgo vacations or cut back on your spending in other areas.

Last but not least, saving and investing for retirement can give you peace of mind. Knowing that you have a nest egg to help you through your golden years can provide a great deal of comfort.

Let me know in the comments below how you plan on saving for your post-work years. Do you have any questions about investments or what options are available to you? I’d be happy to help out!