How to Save Money: The Ultimate Guide

Saving money is one of the most important things that you can do for your financial security. If you can find ways to cut back on your spending, you will be in a much better position to weather any economic storm. In this article, we will discuss some of the best ways to save money and improve your financial situation. We will also provide some tips on how to stick to a budget and make saving money easier than ever!

Current State of Saving in America

Savings are an afterthought in an economy where consumers spend 70% of their income. Is it true that we've got a smartphone that's going to cost $3000? It does not mean we don't know about savings. Most Americans believe that they need $10,000 to cover emergency expenses.

The average American household has only accumulated $5000 in their savings account. Even $5,000 is an inaccurate statistic. There are huge gaps between saving by race and earning.

According to surveys, 80% of people in the United States live paycheck-to-paycheck. Some families are saving for a future that seems to be fantasy to some adults.

The fact is that saving can only be achieved through a sustained commitment. When transitioning from paychecks into paychecks, saving habits should become second nature.

Saving money is one of the most important things that you can do for your financial security. At the end of 2021, 61% of the U.S. population was living paycheck to paycheck, down slightly from a high of 65% in 2020, according to a recent LendingClub report.

If you can find ways to cut back on your spending, you will be in a much better position to weather any economic storm.

In this article, we will discuss some of the best ways to save money and improve your financial situation.

We will also provide some tips on how to stick to a budget and make saving money easier than ever!

Saving Money

When it comes to finances, knowledge is power. The more you know about saving money, the better equipped you will be to make sound financial decisions. Keep reading this ultimate guide to learn everything you need to know about saving money!

How do I save money?

Saving money is not as difficult as it may seem. There are a number of different ways to save, and each person’s approach to saving will be different. Here are a few tips on how to get started.

Saving Money: The Basics

One of the best ways to save money is to create a budget. When you know where your money is going, it is much easier to find areas where you can cut back. There are a number of different ways to budget, so find one that works best for you and stick with it. You may also want to consider using cash instead of credit cards, as this can help you stay within your budget.

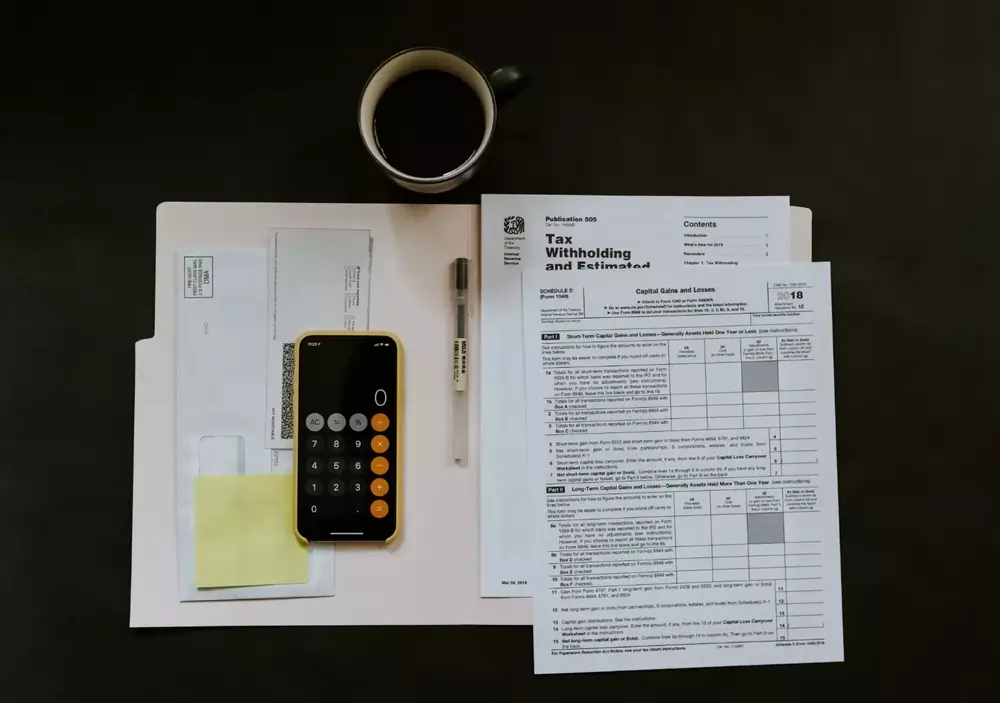

Another great way to save money is to take advantage of tax breaks and deductions. There are a number of different deductions that you may be eligible for, so it is important to research which ones apply to you. You can also save money by taking advantage of tax-free savings accounts and registered retirement plans.

Another great way to save money is to take advantage of discounts and coupons. You can often find coupons for items that you use regularly, which can help you save a significant amount of money over time. You may also want to sign up for loyalty programs at your favorite stores, as these programs can offer discounts and other benefits.

Finally, one of the best ways to save money is to make a plan. When you have a goal in mind, it is much easier to find ways to achieve it. If you want to save money, set a specific goal and come up with a plan on how you will reach it.

1st Step: Create a Budget

You must create a budget to save money. When you know where your money is going, it is much easier to find areas where you can cut back. There are a number of different ways to budget, so find one that works best for you and stick with it. You may also want to consider using cash instead of credit cards, as this can help you stay within your budget.

What's the 50 30 20 budget rule?

The 50-30-20 rule is a great way to start budgeting. The so-called "50/20/20/20" rule was popularized in Elizabeth Warrens's bestselling book, All Your Worth. In simple terms, this rule states that

- 50% of your income should go towards essential expenses, such as rent, food, and transportation.

- 30% of your income can be spent on discretionary expenses, such as entertainment and clothes.

The final 20% should be saved for future goals, such as retirement or a rainy day fund.

When creating your budget, make sure to account for all your monthly expenses, including how much you spend on grocery stores, credit card debt, car loans, debt repayment, mortgage debt, healthcare expenses, etc.

2nd Step: Set an Emergency Fund.

An emergency fund is key to have for when the unexpected comes up. No one knows when they may get into a car accident or need surgery and without an emergency fund, these types of events could put you in debt. How much should you save? A good rule of thumb is to have at least three to six months of living expenses saved.

Something as simple as a broken tooth can bring you an unexpected expense of several hundred dollars.

If you have never established an emergency fund for unexpected expenses, perhaps you will need to start with a smaller goal. Propose yourself to save your first $500, and then, your first $1,000.

You'll become part of the elite! Only 44% of Americans can afford to pay unexpected expenses of up to $1,000.

If you want to learn more about how to create an emergency fund, we suggest that you read our article about this subject.

The best place to put your emergency funds is on an emergency savings account. An emergency savings account can prevent major financial stress, or at least remove much of their pain.

3rd Step: Open a Regular Savings Account

One of the best places to save money is in a savings account. Savings accounts offer a number of benefits, including interest on your deposits and the ability to withdraw your money at any time.

When you are looking for a savings account, be sure to shop around and compare interest rates. You may also want to consider an online savings account, as these accounts often offer higher interest rates than traditional savings accounts.

Make sure that your regular savings account is separate savings account from your emergency savings account.

4th Step: Open a Retirement Savings Account

Retirement savings accounts allow you to save money for your retirement years when you will likely need it the most. There are a number of different types of retirement savings accounts, so be sure to find one that best suits your needs. Some popular retirement accounts include 401(k)s, Roth IRAs, and traditional IRAs.

When opening this kind of savings account, be sure to contribute as much money as you can each month. This will help ensure that you have enough money saved for your retirement years. Especially if your employer matches a certain percentage of your contributions.

Mutual Funds.

A mutual fund is an investment that pools money from many investors and invests it in a variety of securities, such as stocks, bonds, and short-term debt. Mutual funds are managed by professional money managers who seek to grow the fund's assets over time.

When investing in mutual funds, you should consider your financial goals, risk tolerance, and investment timeline.

Roth IRAs.

A Roth IRA is a type of retirement account that allows you to contribute after-tax money, which then grows tax-free. This means that when you withdraw the money in retirement, you will not have to pay any taxes on it.

According to Investopedia.com, to be eligible for a Roth IRA, your annual income must fall below certain limits. For 2021, you can contribute the full amount if you are single and your Modified Adjusted Gross Income (MAGI) is less than $125,000 (or $198,000, if you are married and filing jointly)

Roth IRA Contribution Limits

For 2021, the contribution limit for Roth IRAs is $6000 ($ 7000 if you're age 50 or older). If your MAGI falls below certain levels, you may be able to contribute a reduced amount.

401(k) Accounts

A 401(k) account is a type of retirement savings account that allows you to contribute pre-tax money, which then grows tax-deferred. This means that when you withdraw the money in retirement, you will not have to pay any taxes on it.

Your employer may offer matching contributions to your 401(k) account, which can be a great way to grow your savings.

401(k) contribution limits for 2021 are $19,500 ($26,000 if you're age 50 or older). If you have a SIMPLE 401(k), the contribution limit is $13,500 ($16,500 if you're age 50 or older).

REITs

A REIT is a type of investment that allows you to invest in real estate without actually owning any property. REITs are bought and sold on stock exchanges, just like stocks and bonds.

When you invest in a REIT, you are essentially buying a piece of a company that owns or finances income-producing real estate.

There are a number of different types of REITs, so be sure to do your research before investing.

Types of REITs

The two main types of REITs are equity REITs and mortgage REITs, commonly known as mREITs.

- Equity REITs generate income through the collection of rent on, and from sales of, the properties they own for the long-term.

- Mortgage RETs (mREITs) invest in mortgages or mortgage securities tied to commercial and/or residential properties.

Depending on the type of real estate property, the REITs can be classified into three categories:

- Residential REITs. These REITs invest in apartments, single-family homes, and other residential properties.

- Retail REITs. These REITs invest in retail properties, such as shopping malls and stores.

- Industrial REITs. These REITs invest in warehouses and other industrial properties.

Certificate of Deposit Account (CDs)

A CD, or certificate of deposit, is a type of savings account that offers a fixed interest rate for a certain period of time.

CDs are great for people who want to save money without taking any risk. The downside is that you can't withdraw your money until the CD matures, which could be anywhere from three months to five years.

To open a CD, you usually need to deposit a minimum amount of money, which can vary depending on the bank.

Bonds

A bond is a debt investment in which an investor loans money to an entity (typically corporate or governmental) that borrows the funds for a defined period of time at a fixed interest rate.

Bonds are often used by companies to raise money for capital expenditure, such as building a new factory.

Government bonds, or treasuries, are considered to be the safest type of bond because they are backed by the full faith and credit of the U.S. government.

Municipal bonds are another type of bond that is backed by a government entity, but they are typically used to finance projects within a specific municipality, such as a new school or roads.

5th Step: Open a Health Savings Account (HSA)

Health Savings Account (HSA) is a type of savings account that lets you set aside money on a pre-tax basis to pay for qualified medical expenses.

For 2022, if you have a High Deductible Health Plan (HDHP), you can contribute up to $3,650 for self-only coverage and up to $7,300 for family coverage into an HSA. HSA funds roll over year to year if you don't spend them. An HSA may earn interest or other earnings, which are not taxable.

6th Step: Open a Checking Account

Checking accounts offer a number of benefits, including interest on your deposits and the ability to write checks. When you are looking for a checking account, be sure to shop around and compare fees.

You may also want to consider an online checking account, as these accounts often offer higher interest rates than traditional checking accounts.

We suggest that you set up direct deposit on your checking account, and from there, transfer to all the other accounts, automatically.

Your checking account should hold the minimum amount possible since this type of account pays horrendous interest rates.

7th Step: Automate transfers and deposits

In the early part of an activity, the building of habit should help to avoid unnecessary expenses and help to save time and effort automatically. Basically, these measures satisfy an essential function in establishing the system. Essentially, you'll pass from a habit of spending money to the habit of serving money.

Automatic withdrawals from the bank account should happen each month. You have several choices: First, you may direct deposit the money of your paycheck. if possible, put your take-home pay into your checking account. Then, the specified amount will be transferred to the respective accounts.

8th Step: Paying off Debt

Debt is a huge issue for many Americans. In fact, according to NerdWallet, “The average American household carrying credit card debt has a balance of $16,048.” This is a lot of money that could be used for other things.

If you are in debt, one of the best ways of saving money fast is to pay off your debts. Especially, your high-interest rate debt, like credit cards. When you have a large amount of debt, it can be difficult to make ends meet each month. By paying off your debts, you will free up more money to save and invest. There are a number of different ways to pay off debt, so find one that works best for you and stick with it.

There are two popular methods for paying off debt: the Avalanche Method and the Snowball Method.

The Avalanche Method suggests that you pay off the debt with the highest interest rate first. This will save you the most money in the long run.

The Snowball Method suggests that you pay off the smallest debt first. This can give you a sense of accomplishment and help you stay motivated to continue paying off debt.

Which method is best? It depends on your situation. If you have high-interest debt, then the Avalanche Method is probably best for you.

To learn more about how to pay off your debts fast, read our article, where you'll learn about the faster way to pay off your debts.

9th Step: Cut your Expenses

One of the best ways to save money is by finding ways to reduce your everyday expenses. This can be done by evaluating your spending habits and making changes where necessary. There are a number of different ways to save money on your regular expenses, including:

1. Shopping around for better prices on groceries and household items.

Another way to save money is by buying in bulk. This can be especially helpful when it comes to groceries.

Buying in bulk can sometimes mean getting a lower price per unit. It can also mean getting bigger packages of food. So, be careful to avoid food waste.

2. Finding cheaper alternatives to things you usually buy, like using store brands instead of name brands.

3. Cancelling subscriptions or services that you don't use regularly or that you could live without.

4. Taking advantage of discounts and special offers available from retailers and service providers.

5. Cutting back on dining out and ordering food delivery instead.

6. Making your own coffee instead of buying it at coffee shops. Bear with me on this one.

If you really enjoy going to Starbucks and some quality time enjoying your Latte with friends, of course, yes! Continue doing it!

But, if you only purchase your coffee from the coffee shop to fix your daily doses of sugar and caffeine, then there are other smarter ways to do it.

7. Carpooling or using public transportation instead of driving your own car every day.

When it comes to cutting expenses, it's important to be able to differentiate between the necessary and the unnecessary. Here are a few questions to ask yourself when trying to make that determination:

-Do I need this item? It's funny to see people confusing needs and wants. A great way to start cutting your monthly expenses is by eliminating those "wants" that you don't "need".

-Can I live without this? If the answer to any of this question is no, then you probably don't need that expense.

-Do I have a cheaper alternative?

-Is there a way I can get this for free?

-How often will I use this?

There are many ways to save money, and eliminating unnecessary expenses is a great place to start.

If you apply what is called the 30 days Rule, which consists of waiting 30 days before buying something, you will eliminate, or at least minimize impulse spending.

For example, you can cook at home instead of eating out, or you can shop at discount stores instead of full-price retailers. Meal planning and grocery coupons can also help you save money on your groceries.

There are a number of other ways to cut your expenses, so be sure to find ones that work best for you. By cutting your expenses, you will free up more money to save and invest.

You can also save money on your transportation costs by carpooling or taking public transportation.

By cutting your expenses, you will have more money to save and invest.

10th Step: Investing

When you invest your money, you are essentially putting it into a pool of funds that will be used to generate returns over time. This can be a great way to save money, as you will be able to grow your investment over time.

You’ve probably heard the saying, “Money can’t buy happiness.” But we all know that having money sure makes life a lot easier.

The good news is, you don’t have to be born into a wealthy family to amass a fortune. You can start saving and investing your money using online apps, many of which are free.

When you’re ready to start investing your money, there are a few different online apps you can use to invest like Robinhood or Webull. These apps make it easy for you to invest in stocks, ETFs, and options without paying any commission fees.

Both Robinhood and Webull offer a wide variety of investment options, so you can find the right investment for your needs. They also offer free educational materials to help you learn about investing and make the most of your money.

To get started with Robinhood, simply download the app and create an account. You can then fund your account with a bank transfer or by linking your bank account or credit card. Once your account is funded, you can start investing in stocks, ETFs, and options.

Another great way to invest your money is through an app called Acorns. Acorns App rounds up your purchases to the nearest dollar and invests the difference into a diversified portfolio of ETFs (exchange-traded funds).

One huge mistake people make is to not start investing their money until they are closer to retirement age. If you start investing your money when you're younger, you will have more time for your investment to grow.

There are a number of different ways to invest your money, so find one that works best for you and stick with it.

By paying off your debts and making sure you are saving and investing enough for your retirement years, you are securing your financial future.

11th Step: Review your Progress

It's important to review your progress regularly and make changes as needed. If you aren't meeting your savings goals, or if you are in debt, then it's time to take action and change your habits.

Check your spending habits. How much money are you spending on unnecessary items each month? How can you cut back on your expenses?

If you review your progress regularly and make changes as needed, you will be able to save money successfully. Just remember to take it one step at a time, and don't get discouraged if you have setbacks. Saving money takes time and effort, but it's definitely worth it in the end.

12th Step: Stay Motivated

One of the most important things to remember when saving money is to stay motivated. This can be difficult, especially if you are struggling to meet your savings goals or if you have a lot of debt.

Find ways to stay motivated. This could include setting smaller goals or rewarding yourself for meeting your larger goals. Make sure you are also keeping track of your progress, so you can see how far you have come.

By staying motivated, you will be more likely to stick with your money-saving goals.

13th Step: Ask for Help

If you are struggling to save money or if you have a lot of debt, it's important to ask for help. There are a number of different organizations that can help you get back on track financially.

Credit counseling can help you create a budget and debt repayment plan. Debt consolidation programs can also help you get your finances under control.

There are also a number of online resources that can help you learn about money-saving tips and strategies.

By asking for help, you will be able to get back on track financially and achieve your money-saving goals.

Money-Saving Tip

Saving money can be a lot easier than you think. By following these twelve simple steps, you will be able to save money successfully and achieve your financial goals. Just remember to stay motivated and take it one step at a time!

Start small.

When you're first starting out, it's important to break your larger goals into smaller, more manageable ones. If you want to save $1,000 in six months, for example, start by saving $100 each month. Once you've reached your goal, set a new one within the same time frame.

Many people feel like they need to make big changes in order to save money, but this isn't always the case. Making small tweaks to your spending habits can add up over time and help you reach your savings goals.

One way to save money is to create a budget and stick to it. This may seem like a daunting task, but it's actually easier than you think. Start by listing all of your monthly expenses and then compare them to your income.

Evaluate your spending and income then develop a budget that works for you on what you put in your cart while shopping, especially when it comes to naming brand products. Compare prices and get the best value for your money.

Make a list of what you need to buy BEFORE you go shopping and don't stray from it. And, never go shopping when you are hungry! Make sure you have eaten before, otherwise, you are going to end up overspending on stuff that you didn't have on your shopping list, and are not necessarily healthy.

Bring a packed lunch with you to work instead of buying food from the vending machine or local restaurants. Remember, meal prepping can also help you save money by cooking in bulk and avoiding eating out.

Avoid unnecessary expenses by cutting back on things like cable, internet, and cell phone bill. If you are not happy with your service provider, shop around and compare, until you find one that provides the services you are looking for, at the right price.

That also applies to insurance policies. Research the best deals on insurance policies, whether it be for your car, home, health, or pet.

Stay cozy and warm all winter by preparing your home before the cold weather hits. Weatherize your windows, doors, and insulation, and wear warmer clothing in the winter so you don't have to crank up the heat.

Be mindful of your debt and make a plan to pay it off as quickly as possible.

Automate your savings so that you're paying yourself first, then work on building up your emergency fund. Investing is another key factor in saving money for the future. Review your progress regularly t

Stay Consistent

The most important thing to remember when saving money is to stay consistent. This means setting aside a certain amount of money each month and sticking to it.

If you can't afford to save as much as you would like, start small and gradually increase your savings over time. By staying consistent, you will be able to achieve your savings goals.

Set Savings Goals

One of the best ways to save money is to set savings goals. This will help you stay focused and motivated, and it will also give you something to work towards.

Think about what you want to save for, and then come up with a realistic savings goal. Once you have a goal in mind, start saving money toward your goal.

14th Step: Review & Recap

Follow these 12 simple steps in order to successfully save money. Making sure you have a plan and goal in mind is critical for saving money.

Making Extra Money

If you are looking for ways to save money, consider making extra money. Sometimes, a full-time income is not enough to get ahead financially. That is an excellent reason to find a side hustle or a part-time job that would allow us to put that extra income not toward our monthly expenses, but toward saving money.

Making more money doesn't have to be difficult. In fact, there are plenty of simple ways to make spare cash on the side. Here are a few tips:

1. Use coupons for rebates, cash-back, or discounts when shopping.

When clipping coupons, many shoppers think of the immediate discount the coupon will provide. However, savvy shoppers know that many coupons offer rebate values, cash-back opportunities, and discounts beyond the initial item savings.

For example, a recent purchase of laundry detergent yielded a $2 coupon off the purchase price. In addition to the $2 off, the store offered a $5 rebate if the purchase was made on a certain day. The total effective discount on that purchase was therefore $7 ($2 off + $5 rebate).

Similarly, when shopping online, be sure to check for coupon codes that offer additional discounts or cash-back rewards. For example, one online retailer offers 10% cash-back on all purchases and another offers free shipping on orders over $50. Combining these two codes can result in significant savings on any purchase.

2. Earn cash back on everyday purchases by using a rewards credit card.

There are a number of different rewards credit cards available, so it's important to find one that offers the type of rewards that you're interested in. Some cards offer cashback on every purchase, while others offer points that can be redeemed for merchandise or travel. No matter what type of rewards card you choose, you'll be able to save money on your everyday purchases.

3. Sell unwanted items online or at a garage sale.

Selling stuff that you don't use or need, not only will help you earn cash but will help you declutter your home. When it comes to getting rid of unwanted items, there are a few different options. You can sell them online, or you can hold a garage sale. Both of these methods have their own advantages and disadvantages.

Selling items online is a great way to make some spare cash. You can use websites like eBay or Craigslist to list your items for sale. The advantage of selling online is that you can reach a large audience of potential buyers. The disadvantage is that it can be time-consuming to list and sell your items.

Garage sales are another option for getting rid of unwanted items. The advantage of garage sales is that they are easy to set up, and they don't require any special skills or knowledge. The disadvantage is that you may not reach as many people as you would with an online sale.

4. Participate in paid online surveys or sign up for paid focus groups.

If you're looking for a way to make more money, you may want to consider participating in paid online surveys or signing up for paid focus groups. By doing so, you can earn a little extra cash while helping companies learn what consumers think about their products or services.

Participating in paid online surveys is a great way to save money. By taking a few minutes to complete surveys, you can earn money that can be used to pay for groceries, bills, and other expenses.

What's more, by signing up with several different survey companies, you can increase your chances of receiving more survey invitations.

Signing up for paid focus groups is another great way to make some spare money. Unlike online surveys, focus groups typically require participants to attend an in-person meeting. However, the pay is typically higher than what you would earn from completing online surveys.

For example, companies like Nielsen pay you up to $150 per month for participating in their ratings surveys. The only detail is that you don't get to choose them, they choose you.

5. Rent out a spare room in your house on Airbnb or similar platforms.

Here are a few reasons why renting out a spare room can be a good idea:

First, renting out a spare room can help you make extra money. This can be helpful if you need to save money or if you want to pay off debt.

Second, renting out a spare room can help you save money on your mortgage or rent. By bringing in an extra tenant, you can cover some of your housing costs.

Finally, renting out a spare room can help you meet new people and make connections in your community. This can be especially helpful if you are new to town or if you don’t have any friends yet.

I remember that I rented a room from an attorney's apartment that was located close to the university I studied my first career. He was making an extra $500 per month for a spare room he didn't have a use anyway.

6. Offer pet-sitting services or dog walking/boarding services.

If you love spending time with animals, consider offering pet-sitting services. This can be a great way to make spare cash, and it doesn’t require a lot of training or experience.

Both of these services can be done in your own neighborhood, which means you don’t have to spend money on gas or transportation. And, since you’re already taking care of animals, there’s no need to purchase any additional supplies or materials.

You may want to start by advertising your services on websites like Craigslist or Care.com or DogVacay, or even on the bulletin board of your community

7. Use your tax refunds as a way to putting money toward our retirement plan

When it comes time to receive our tax refund, many of us think about how we're going to spend it. It's easy to get caught up in the idea of using that money to improve our household budget by taking care of some overdue bills or finally upgrading our worn-out furniture. However, this year, why not consider using your tax refund as a way to put extra money toward your retirement plan?

It might not seem like the most exciting option but think of all the things you could do with a little more money saved for retirement. You could invest in stocks or mutual funds, contribute to an IRA or even just put the money into a high yield savings account where it can earn interest over time.

No matter what you choose to do with your extra retirement savings, putting them away now will definitely help secure your future financial security.

There are a number of additional ways to make some more money, so find one that works best for you and stick with it. By making extra money, you will be able to reach your financial goals faster.

In conclusion, saving money is a lifelong process that should be monitored regularly in order to stay on track and reach financial goals. Making small changes can have a big impact down the road, so be sure to evaluate your progress and make alterations as needed.

Thanks for reading!

PS. What are your favorite tips for saving money? Let us know in the comments below.

Affiliate Disclaimer: https://ivanremus.com is owned and operated by Ivan Remus and may contain advertisements, sponsored content, paid insertions, affiliate links, or other forms of monetization.

For more detailed information, please, refer to our Disclaimer Page.